Bybit CEO Says Crypto liquidation Exceeds $2B

Ben Zhou, CEO of Bybit, mentioned the latest crypto liquidation that affected over 720,700 merchants within the final 24 hours is much worse than reported.

The crypto market skilled a crash in response to U.S President Donald Trump’s new tariff assertion, and Bitcoin and Ether led the crash. Bitcoin dropped beneath $92k whereas ETH dropped to $2400 because it misplaced 17% of its worth in a single day.

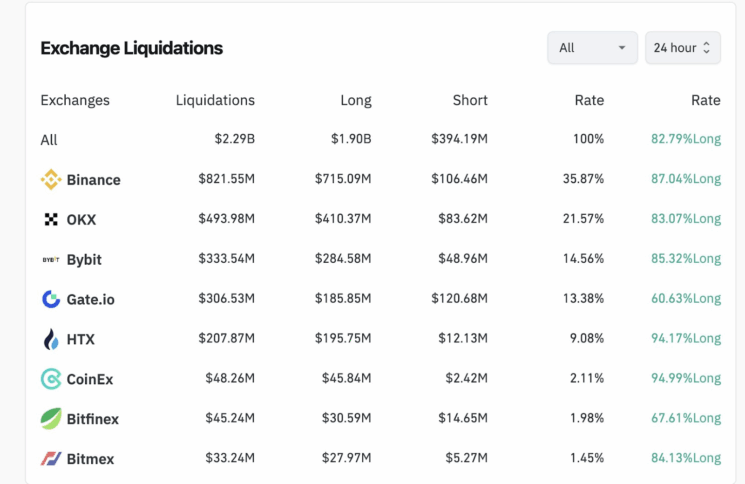

Nevertheless, Zhou, in a latest tweet, mentioned the precise liquidation determine, which was estimated to be $2.24 billion, was manner larger.

“I’m afraid that immediately’s actual whole liquidation is much more than $2B”

Zhou estimates the precise quantity to be between $8 billion and $10 billion. He mentioned that Bybit has API limitations that prohibit how a lot liquidation is displayed, that means that merchants won’t be seeing the total losses, and the market scenario may even be worse than it seems.

Proper now, Ethereum is buying and selling for $2,713, after gaining again 7% for the day based on Coingecko.

Ethereum noticed the most important loss, with $622 million in lengthy and short-liquidated positions, based on Coinglass Lengthy positions took a beating too, with $1.9 billion in liquidation, representing 84% of the general determine. Ethereum longs represented $473 million of that determine.

Presto Analysis’s analyst Min Jung mentioned that Ethereum’s sharp fall was a lot better in comparison with Bitcoin and Solana. She added that Ethereum’s poor efficiency additionally has to do with some inside battles in its Ethereum Basis, which included the management battles and its transition in direction of turning into extra institutional. In keeping with her, all of this created a destructive sentiment in direction of the coin.

In the meantime, that is ETH’s largest intraday drop since Might 2021, when it dropped from a excessive of $4,308 to $2,200 in seven days. On the time, Ethereum traded at virtually 48% beneath its file excessive of $4,878 from November 2021.

Furthermore, the volatility spike throughout the crash was huge. In Asia buying and selling hours, Ethereum’s one-day at-the-money volatility rose from 34% to 184%, which implies a whole lot of merchants panicked.

The put-call ratio, an indicator that measures how merchants understand danger, elevated from 0.6 to 2.5. Additionally, a dormant whale transferred $228.6 million price of Ethereum to Bitfinex on the eleventh hour, placing further stress on sell-offs.

However what brought about this crash? Nicely, the general market was already on edge on account of Trump’s new tariffs. These tariffs impacted Canada, Mexico, and China and elevated considerations about inflation and decelerating the economic system.

Many traders stayed away from high-risk investments like cryptocurrencies on account of these considerations. Traditionally, such political rigidity typically put stress available on the market.

Proper now, the crypto market could be very unstable. If the stress will get worse, it may result in a bearish pattern.

Additionally Learn: Trump-Backed WLFI and Crypto Portfolio Drops Amid Market Crash